Managing finances can be time-consuming and challenging in the fast-paced business world. Traditionally, bookkeeping involved tracking each transaction manually, which led to errors, delays, and unnecessary stress. However, the automation of bookkeeping has changed everything. By leveraging automation tools, businesses can save time, reduce human error, and ensure financial records remain accurate and up-to-date. In this article, we’ll explore what bookkeeping automation is, its benefits, and how it can help your business grow.

What is Bookkeeping Automation?

Bookkeeping involves recording financial transactions such as purchases, sales, income, and payments. Traditionally, business owners or accountants handled these tasks manually. However, with automation tools, this process has become more streamlined. Bookkeeping automation uses software to perform these tasks, automatically categorizing expenses, creating financial reports, and even handling tax calculations.

This technology has enabled businesses to take a hands-off approach to managing their financial records, saving time and resources. Automated bookkeeping tools integrate with bank accounts, credit cards, and other economic systems to track real-time transactions, making the process more efficient and less prone to errors.

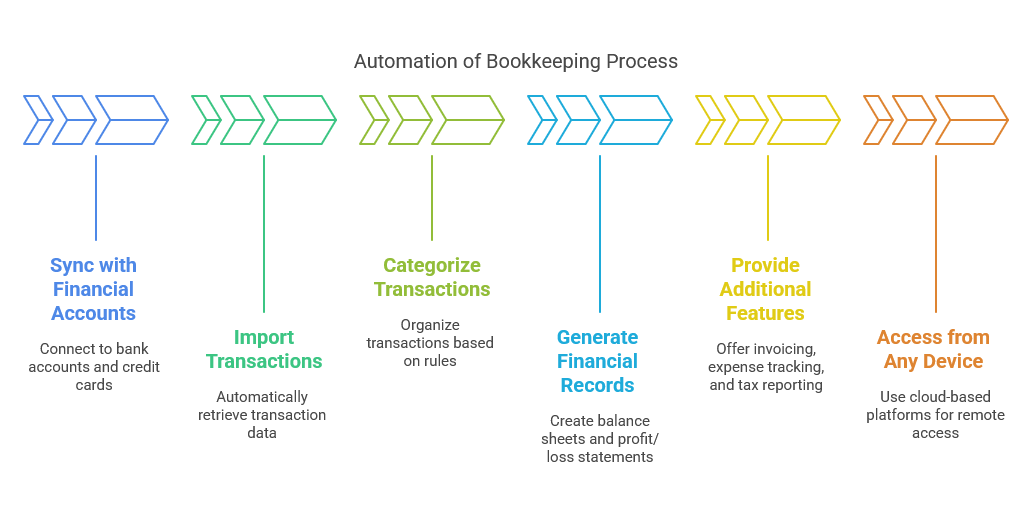

How Does Automation of Bookkeeping Work?

Automation tools work by syncing with your financial accounts, including bank accounts and credit cards. Once connected, the software automatically imports transactions from these accounts. The system categorizes each transaction based on pre-set rules and generates financial records, such as balance sheets and profit and loss statements.

Modern bookkeeping automation tools also provide additional features like invoicing, expense tracking, and tax reporting. These tools allow business owners to manage their finances with minimal effort, all while improving the accuracy of their financial data.

For example, tools like QuickBooks, Xero, and FreshBooks offer cloud-based platforms that can be accessed from any device. This enables business owners to track their finances from anywhere without manual intervention.

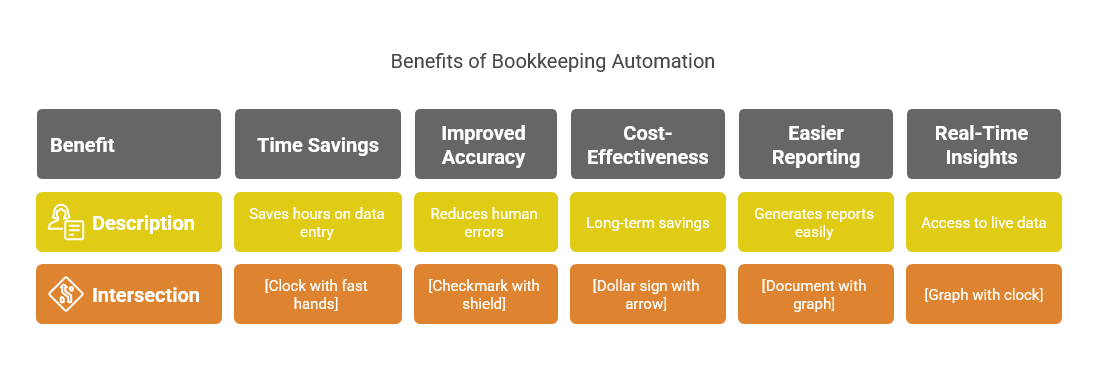

Benefits of Automating Bookkeeping

1. Time Savings

One of the most significant advantages of bookkeeping automation is the amount of time it saves. Traditionally, business owners had to spend hours entering data manually, reconciling accounts, and preparing financial reports. With automated tools, all of this is done for you in a fraction of the time.

You no longer have to spend hours tracking expenses, calculating taxes, or generating reports. Automation handles these tasks instantly, freeing up your time to focus on more critical aspects of your business, such as sales and customer service.

2. Improved Accuracy

Human errors are inevitable, especially when handling large volumes of financial data. Simple mistakes, like entering a wrong number or forgetting to categorize a transaction, can lead to inaccurate financial records. These errors can result in missed tax deductions, incorrect financial statements, or audits from tax authorities.

Automation reduces the chances of such mistakes. Using algorithms to track and categorize transactions, automation ensures that every financial record is accurate. This reliability is crucial for businesses that need to maintain financial transparency.

3. Cost-Effectiveness

While there may be an initial investment in automation software, the long-term savings make it a cost-effective solution for businesses. Outsourcing bookkeeping to an accountant can be expensive, especially for small businesses with limited budgets. Automation allows companies to reduce or eliminate the need for a full-time accountant.

With automated bookkeeping, businesses only need to pay for the software, which is often less expensive than hiring someone to manage your finances manually. Over time, this can result in substantial cost savings.

4. Easier Financial Reporting

Financial reporting is a vital part of running a business. Whether you need to prepare a profit and loss statement for investors, generate tax reports, or track your cash flow, financial reports give insight into your business’s performance.

Automation simplifies this process by generating reports with a single click. Most bookkeeping automation tools allow you to customize these reports to suit your needs, providing an up-to-date overview of your business’s financial health at any time.

5. Real-Time Insights

Another advantage of bookkeeping automation is the ability to access real-time financial data. Traditional bookkeeping methods often result in outdated records, leading to poor decision-making. With automation, you can view your financial information in real time, giving you a clear picture of your cash flow, income, and expenses at any moment.

This feature is essential for making timely decisions, such as adjusting budgets, tax planning, or monitoring cash flow. Automation tools allow business owners to be proactive rather than reactive when managing their finances.

Key Features of Bookkeeping Automation Tools

Automation tools come with a variety of features that simplify financial management. Some of the most valuable features include:

1. Bank Synchronization

Automated bookkeeping tools can sync directly with your bank accounts, credit cards, and other financial institutions. This synchronization ensures that all of your transactions are automatically recorded and categorized, eliminating the need for manual data entry.

2. Invoicing and Payment Tracking

Most bookkeeping automation tools allow you to create and send invoices automatically. You can set up recurring invoices for regular clients, ensuring timely payments. Additionally, these tools can track expenses, send reminders, and notify you of overdue invoices.

3. Expense Management

Keeping track of business expenses can be challenging, especially when dealing with receipts and bills. Automation tools make it easier by automatically categorizing and tracking expenditures over time. This feature helps you understand where your money is going and find opportunities to cut costs.

4. Tax Calculation

Tax calculations can be complex, but automation tools simplify the process. Many platforms offer built-in tax calculations, helping you calculate sales tax, income tax, and other liabilities based on your transactions. This feature ensures that your tax records are accurate, making tax filing a breeze.

5. Customizable Financial Reports

Automation tools offer a range of customizable financial reports. These reports can include balance sheets, profit and loss statements, cash flow statements, and more. Customization options allow you to tailor the reports to your business’s needs, helping you make informed decisions based on your financial data.

Challenges of Bookkeeping Automation

While automation offers many benefits, there are a few challenges to consider:

1. Learning Curve

Switching from manual bookkeeping to automation can take some time. Business owners may struggle to navigate the software or set up the system to suit their needs. However, most automation tools offer tutorials and customer support to help users get started.

2. Cost of Software

The initial cost of automation software can be a barrier for some businesses. While the long-term savings are significant, smaller businesses with limited budgets may find the upfront cost challenging. However, many tools offer flexible pricing plans, making automation accessible to companies of all sizes.

3. Data Security

Security is a top priority when using automated bookkeeping tools. Since your financial data is stored online, you must ensure the software provider has strong security measures. Look for tools that offer encryption, secure cloud storage, and data protection protocols.

Who Should Use Automation of Bookkeeping?

1. Small Business Owners

Small businesses often face challenges in managing their finances due to limited resources. Automation offers a cost-effective solution for handling bookkeeping tasks without hiring a full-time accountant. Tools like QuickBooks and Xero are affordable and easy to use, making them ideal for small businesses.

2. Freelancers and Entrepreneurs

Freelancers and entrepreneurs who juggle multiple clients and projects can benefit from bookkeeping automation. The tools allow them to track income and expenses, generate invoices, and manage taxes effortlessly, ensuring they stay on top of their finances.

3. Large Enterprises

Large businesses can also benefit from automation, though their needs may be more complex. Enterprise-level software often integrates with other business systems, allowing seamless financial management across departments and locations.

Bookkeeping automation is an innovative and efficient solution for businesses of all sizes. It saves time, reduces errors, and provides real-time financial insights that help you make better decisions. Whether you’re a small business owner, a freelancer, or a large corporation, automating your bookkeeping process can improve accuracy, cost savings, and overall financial management.