Equitest Financial Analytics Tool In today’s competitive business world, every decision a company makes is crucial to its growth and success. Financial analysis is a key part of this, helping businesses understand their cash flow, identify risks, and find opportunities. With so many financial analytics tools available, it can be hard to determine which one is the best for your needs. One tool that stands out in the market is Equitest.

Equitest is a comprehensive financial analytics platform that helps businesses optimize their financial strategy through real-time data tracking, reporting, and forecasting. In this blog post, we’ll review Equitest’s features, pricing, and how it can help businesses make smarter financial decisions.

The global financial analytics market continues to grow rapidly. A 2024 Statista report projects the financial analytics market to reach $16.3 billion by 2026, with a CAGR of 10.1% from 2021 to 2026.

What is Equitest Financial Analytics Tool?

Equitest is a financial analytics software that simplifies complex financial analysis for businesses. It helps companies track their financial health, analyze key metrics, and forecast future performance with ease. Whether you run a small startup or a large corporation, Equitest provides tools designed to give you insights into your financial data and help you make better decisions.

The platform’s core functionality revolves around collecting data from various financial sources, analyzing it, and presenting it in an easy-to-understand format. It offers a wide range of features, including customizable dashboards, financial reporting, risk management tools, and real-time analytics, making it a versatile tool for businesses across multiple industries.

Features of Equitest Financial Analytics Tool

Equitest is packed with features that can help businesses gain a deeper understanding of their financial data. Here’s a breakdown of the most important features:

-

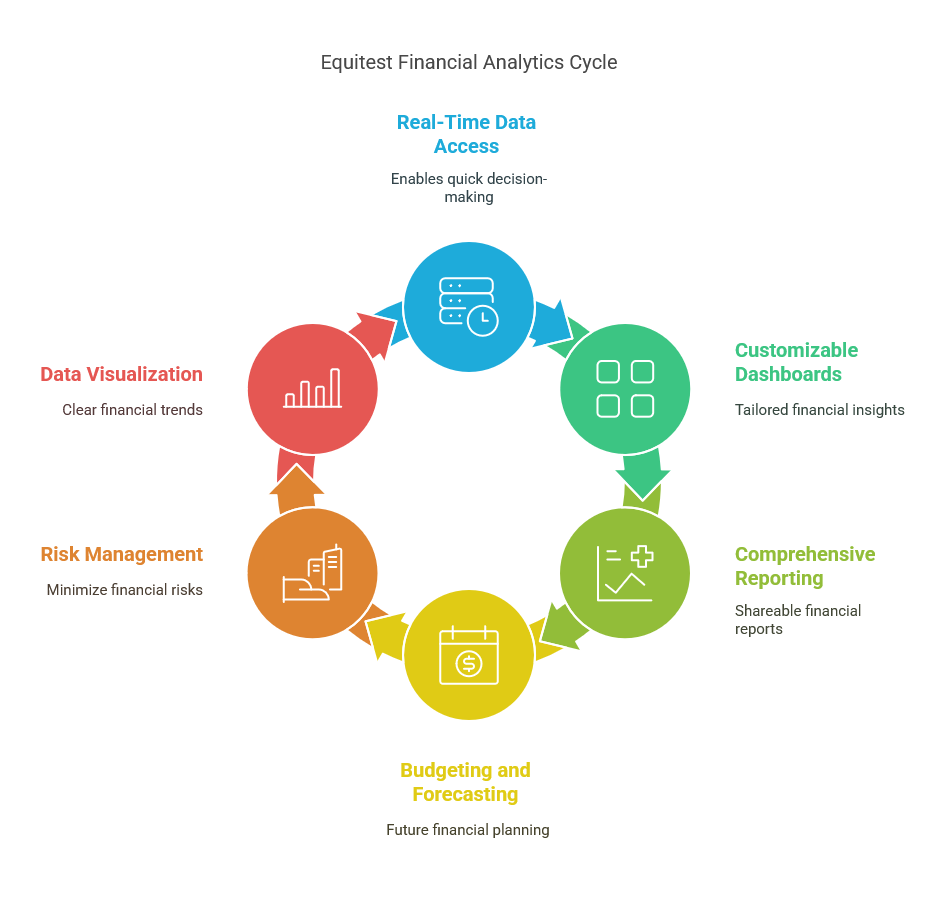

Real-Time Data Analytics

Equitest allows businesses to access real-time financial data, enabling quick decision-making. By tracking key performance indicators (KPIs) in real time, businesses can spot trends and make necessary adjustments to avoid potential losses or capitalize on emerging opportunities. -

Customizable Dashboards

The platform provides users with customizable dashboards that can be tailored to fit their specific needs. This is especially beneficial for businesses that require detailed insights into particular aspects of their finances, such as cash flow, expenses, or profits. The user-friendly interface ensures that you can easily navigate through your financial data. -

Financial Reporting

Equitest provides comprehensive financial reporting tools, allowing users to generate detailed reports on various financial metrics. These reports can be exported for further analysis or shared with stakeholders. This feature is especially useful for businesses that need to present their financial data to investors, lenders, or partners. -

Budgeting and Forecasting

Budgeting and forecasting are essential for businesses looking to plan for the future. Equitest makes it easy to create accurate budgets and forecasts based on historical financial data and current market trends. This helps businesses stay on track and prepare for future financial challenges. -

Risk Management

Managing financial risks is one of the most important tasks for any business. Equitest’s risk management features help businesses identify potential threats and assess their impact on the bottom line. With risk assessment tools, you can minimize exposure to financial risks, allowing you to make more informed decisions. -

Data Visualization

Equitest offers powerful data visualization tools, turning complex financial data into clear and digestible graphs, charts, and tables. This makes it much easier to analyze financial trends and communicate findings to stakeholders.

Pros and Cons of Equitest Financial Analytics Tool

Like any software, Equitest comes with its set of advantages and drawbacks. Here’s a quick rundown:

Pros:

- User-Friendly Interface: The tool is designed to be simple to use, with an intuitive interface that makes it easy for users with limited financial knowledge to navigate.

- Customizable: You can customize the dashboards and reports according to your business needs, giving you more control over your financial analysis.

- Real-Time Data: The ability to track financial data in real-time ensures that businesses can make quick and informed decisions, reducing the chances of financial setbacks.

- Comprehensive Reporting: Equitest provides detailed financial reports, helping businesses stay on top of their expenses, revenues, and profits.

- Scalable: Equitest can be used by businesses of all sizes, from small startups to large corporations.

Cons:

- Limited Integrations: Some users have noted that Equitest doesn’t integrate with as many third-party tools as some of its competitors. If you use other software for things like payroll or inventory management, this could be a limitation.

- Pricing: While Equitest offers a lot of value, it may be more expensive than other financial tools, especially for small businesses. The pricing structure is tiered based on the size of the business, which can be costly for startups.

How Equitest Can Help Your Business

Equitest is designed to provide businesses with the insights and tools they need to make smarter financial decisions. Here’s how it can help your business:

-

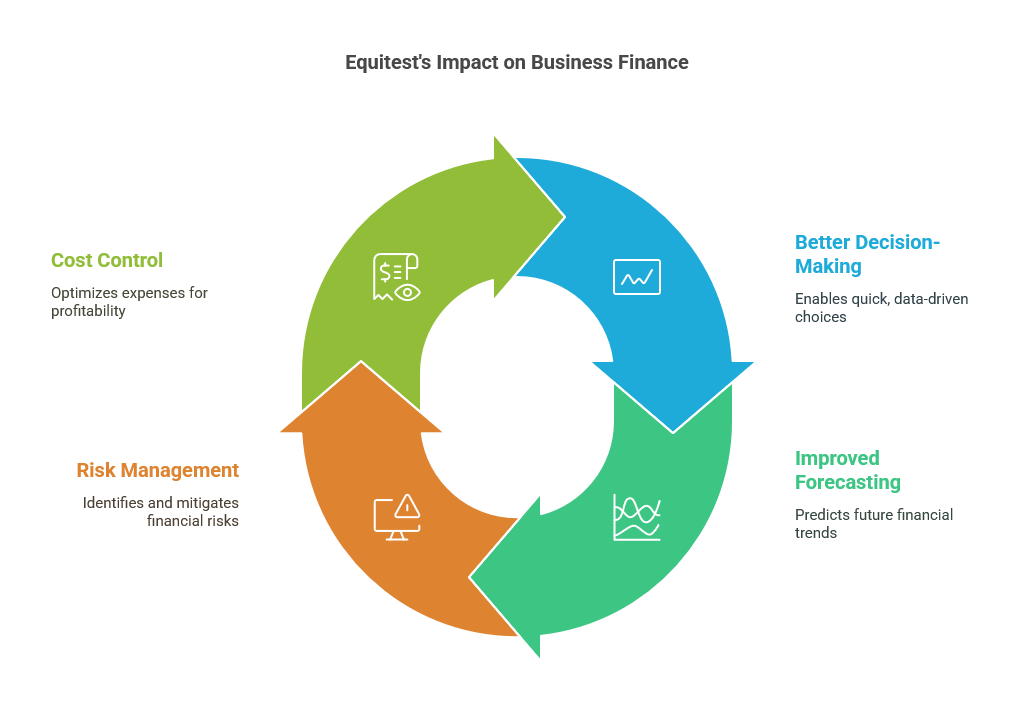

Better Decision-Making

By providing real-time data analytics, Equitest allows businesses to make quick, data-driven decisions. Whether it’s adjusting spending habits or capitalizing on emerging trends, the ability to analyze financial data on the fly gives businesses an edge. -

Improved Forecasting and Budgeting

Equitest’s budgeting and forecasting tools help businesses plan for the future. By analyzing historical data and current trends, Equitest can predict future revenues, expenses, and profits, helping you prepare for financial challenges before they arise. -

Risk Management

Every business faces financial risks. Whether it’s fluctuating market conditions or unexpected expenses, Equitest helps businesses assess and manage these risks. By identifying potential threats early, businesses can take steps to mitigate them and reduce their impact. -

Cost Control

One of the most significant benefits of using Equitest is its ability to track and manage expenses. By keeping a close eye on spending, businesses can identify areas where they can cut costs, leading to improved profitability in the long run.

Pricing of Equitest Financial Analytics Tool

Equitest offers a tiered pricing model to suit businesses of all sizes. While pricing information is not always readily available on their website, the tool typically offers a basic plan for small businesses and scaled-up options for larger enterprises. The cost of the tool will depend on the number of users, the features required, and the level of support needed.

For small businesses on a tight budget, Equitest may seem a bit pricey. However, for larger businesses or enterprises that need robust financial analysis, the platform offers significant value.

Customer Reviews and Feedback

Customer feedback plays a crucial role in assessing whether a financial analytics tool is worth your investment. Here’s what some users have to say about Equitest:

- “Equitest has made it so much easier to track our expenses and manage our financial reports. The customizable dashboard is a game-changer.” – Jenny, Small Business Owner

- “I love the real-time data analytics feature. It helps us stay on top of our financial health and make timely decisions.” – Tom, CFO

- “The platform is easy to navigate, but I wish it had more integrations with other business tools we use.” – Angela, Financial Analyst

Frequently Asked Questions (FAQs)

1. What types of businesses can benefit from using Equitest?

Equitest is suitable for businesses of all sizes, from small startups to large enterprises. It works well for businesses in a variety of industries, including retail, finance, healthcare, and manufacturing.

2. Can I integrate Equitest with other business tools?

While Equitest offers some integrations, it does not have as many third-party integrations as some of its competitors. It’s essential to evaluate your other software before choosing Equitest.

3. Does Equitest offer customer support?

Yes, Equitest offers customer support via email, phone, and live chat to assist you with any issues you may encounter.

4. Is Equitest easy to use for beginners?

Yes, Equitest is designed with an intuitive interface that makes it accessible for users with little financial knowledge.

5. How secure is my data on Equitest?

Equitest uses advanced encryption methods to ensure the security of your financial data. The platform follows industry standards to protect sensitive information.

Equitest Financial Analytics Tool offers businesses the ability to track, analyze, and forecast their financial health with ease. Its real-time data analytics, customizable dashboards, and comprehensive reporting tools make it a valuable asset for businesses that want to make better financial decisions. While it may be more expensive than some other tools, the features and benefits it offers make it a solid choice for businesses that want to streamline their financial analysis process.

If you’re looking for a reliable and user-friendly financial analytics tool, Equitest might just be the right fit for your business.