The Social Security Fairness Act has been widely discussed among public sector workers, retirees, and lawmakers. The bill, which aims to eliminate reductions in Social Security benefits, has given hope to millions of Americans. This is especially true for professions like teaching, firefighting, and law enforcement. Public sector workers, including teachers, police officers, and firefighters, face unfair reductions in their Social Security benefits due to provisions like the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

Many of those affected by these provisions are waiting for a resolution. The key question is: Did President Biden sign the Social Security Fairness Act into law?

Let’s explore the details of this critical bill, its potential impact on public sector workers, and the challenges it faces in Congress.

What Is the Social Security Fairness Act?

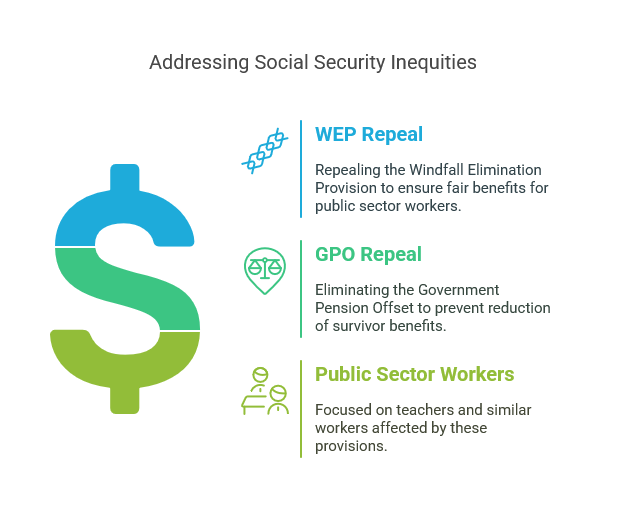

The Social Security Fairness Act is a proposed bill that would repeal two provisions in Social Security law. These provisions—WEP and GPO—reduce benefits for certain workers. The bill aims to eliminate these provisions, which could change the financial future of millions of retirees.

Windfall Elimination Provision (WEP)

The Windfall Elimination Provision (WEP) affects individuals who have worked in jobs that didn’t contribute to Social Security but are receiving a pension. Many public sector workers, such as teachers, police officers, and firefighters, are impacted by WEP. These workers often receive pensions from state or local government jobs. However, their private-sector jobs may have contributed to Social Security.

Under WEP, these workers’ Social Security benefits are reduced. Even though they’ve paid into Social Security through other jobs, they often receive a much lower benefit. This results in financial hardship during retirement.

Government Pension Offset (GPO)

The Government Pension Offset (GPO) affects spouses or surviving spouses of public sector workers. GPO reduces or eliminates spousal and survivor benefits for individuals receiving government pensions. If a public worker’s spouse is entitled to Social Security benefits, those benefits may be reduced or eliminated due to GPO.

The GPO disproportionately affects widows and widowers of public sector workers. It often leaves them with little or no Social Security income. This provision is seen as unfair because it penalizes individuals who were not employed in the same government job as the deceased worker.

Why Do We Need the Social Security Fairness Act?

The Social Security Fairness Act aims to repeal WEP and GPO and ensure that public sector workers and their families receive all the Social Security benefits they deserve.

For example, teachers who have worked in public schools for their careers may be disproportionately affected by WEP. This is because they may not have contributed to Social Security during their teaching years. Additionally, if married to a public sector worker, their survivor benefits could be reduced or eliminated because of GPO.

The Social Security Fairness Act seeks to correct this inequality and ensure fairness for these workers, who have often dedicated their lives to serving their communities.

Has President Biden Signed the Social Security Fairness Act?

As of March 2025, President Joe Biden has not signed the Social Security Fairness Act into law. While the bill has received significant attention and support, it has not yet passed the House and Senate. Once it passes both chambers, it will be sent to President Biden’s desk for signature.

President Biden has publicly supported efforts to reform Social Security. He has acknowledged that WEP and GPO disproportionately impact public sector employees and their families and expressed his commitment to finding a fair solution.

What’s Holding the Bill Back?

While the Social Security Fairness Act has broad support, it faces several hurdles in Congress, which have delayed its passage into law.

1. Financial Concerns

One of the main reasons the bill hasn’t passed is the concern over its financial impact. Eliminating WEP and GPO would lead to higher payouts for public sector workers. This could strain the Social Security Trust Fund.

The Congressional Budget Office (CBO) estimates that repealing these provisions could cost over $183 billion over the next decade. Lawmakers are concerned about how to fund these increased payouts without hurting the Social Security program’s overall financial health.

2. Congressional Gridlock

Despite bipartisan support, political disagreements and gridlock in Congress have stalled the Social Security Fairness Act. Both Democrats and Republicans support the bill, but they cannot agree on how to handle the financial implications of repealing WEP and GPO.

Many lawmakers are reluctant to pass legislation that could increase the federal deficit or harm the sustainability of the Social Security system. As a result, the bill has been delayed due to these ongoing disagreements.

3. Competing Legislative Priorities

Congress often focuses on other pressing issues, such as healthcare, inflation, and national security. These issues precede Social Security reform, so the Social Security Fairness Act has not been a top legislative priority.

Many advocates believe the upcoming 2025 elections could determine whether the bill advances. The bill may have renewed momentum if Social Security becomes a more significant issue during the elections.

Who Would Benefit from the Social Security Fairness Act?

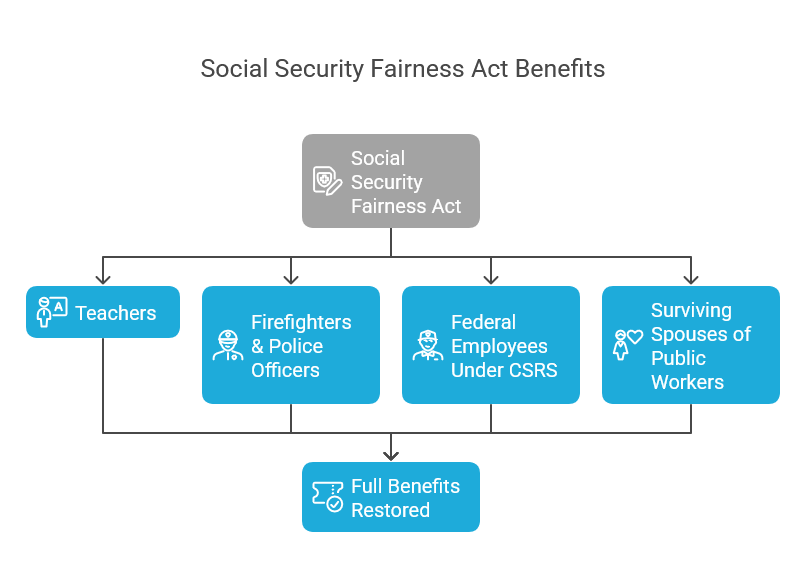

If passed, the Social Security Fairness Act would help over 3 million public sector workers affected by WEP and GPO. Here’s how different groups would benefit:

1. Teachers

Many public school teachers do not contribute to Social Security because they are part of state or local pension systems. WEP unfairly reduces their Social Security benefits, even if they’ve worked in other jobs where they contributed to Social Security. If the bill passes, teachers will receive their full benefits, providing them with financial security in retirement.

2. Firefighters & Police Officers

First responders, such as firefighters and police officers, often have government pensions but also work second jobs contributing to Social Security. Even though they’ve paid into the system, WEP reduces their Social Security benefits. Repealing WEP would ensure that these workers receive the benefits they deserve.

3. Federal Employees Under CSRS

WEP and GPO also impact federal workers under the Civil Service Retirement System (CSRS). These workers often see their Social Security benefits reduced or eliminated due to government pensions. The Social Security Fairness Act would restore their full benefits, ensuring fairness for these workers.

4. Surviving Spouses of Public Workers

The GPO reduces or eliminates Social Security benefits for surviving spouses of public sector workers. If the bill passes, widows and widowers would regain financial security, as their Social Security survivor benefits would no longer be subject to GPO reductions.

Financial Impact of Repealing WEP and GPO

If the bill passes, retirees affected by WEP and GPO could see significant increases in their monthly benefits. On average, retirees could see an increase of $400 to $900 monthly. Some proposals suggest retroactive payments, meaning retirees previously affected by WEP and GPO could receive lump-sum payments for their denied benefits.

Why Do Some Oppose the Bill?

Some critics argue that repealing WEP and GPO could strain Social Security despite its support. They believe that the cost of repealing these provisions could jeopardize the program’s long-term financial health.

Supporters, however, argue that these provisions unfairly penalize public sector workers who have dedicated their careers to public service. They believe the benefits of passing the bill outweigh the potential financial concerns.

FAQs

1. What is the Social Security Fairness Act? The Social Security Fairness Act is a proposed bill that would eliminate the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO), which reduce Social Security benefits for public sector workers.

2. How does WEP affect public sector workers? WEP reduces the Social Security benefits of workers who have a government pension but also work in private-sector jobs that contribute to Social Security.

3. What is the Government Pension Offset (GPO)? GPO reduces or eliminates Social Security spousal and survivor benefits for individuals receiving a government pension.

4. If the bill passes, how much could retirees benefit? Retirees affected by WEP and GPO could see increases of $400 to $900 per month in their Social Security benefits.

5. Why hasn’t the bill passed yet? The bill faces obstacles due to financial concerns, political gridlock, and competing legislative priorities.

The Social Security Fairness Act could improve the financial future of millions of retirees and public sector workers impacted by WEP and GPO. While President Biden has not signed the bill into law, his support for Social Security reform gives hope to those affected by these provisions.

The bill faces several hurdles, including financial concerns and political gridlock. But advocacy efforts continue to push for its passage. If signed into law, it would ensure public sector workers and their families receive the Social Security benefits they deserve. Until then, the fight for fair Social Security benefits remains ongoing.