The Capital One data breach is one of the most significant data security incidents in recent years. It affected millions of customers, exposing sensitive personal information. Fortunately, a settlement has been reached, offering relief to those impacted. But what exactly is the Capital One data breach settlement, and how does it affect you?

What Happened in the Capital One Data Breach?

In 2019, Capital One revealed a massive data breach that impacted over 100 million individuals in the United States and Canada. The breach occurred when a former Amazon Web Services (AWS) employee exploited a vulnerability in the cloud infrastructure hosting Capital One’s data.

The breach exposed personal information, including names, addresses, credit scores, social security numbers, bank account numbers, etc. Customers who applied for or held credit card accounts with Capital One were among the primary victims.

For many, this breach was a significant wake-up call about the vulnerability of their personal information online. The company took immediate action to contain the breach and notify affected individuals. However, the consequences of the breach have lingered, with many questioning the adequacy of Capital One’s response.

The Capital One Data Breach Settlement

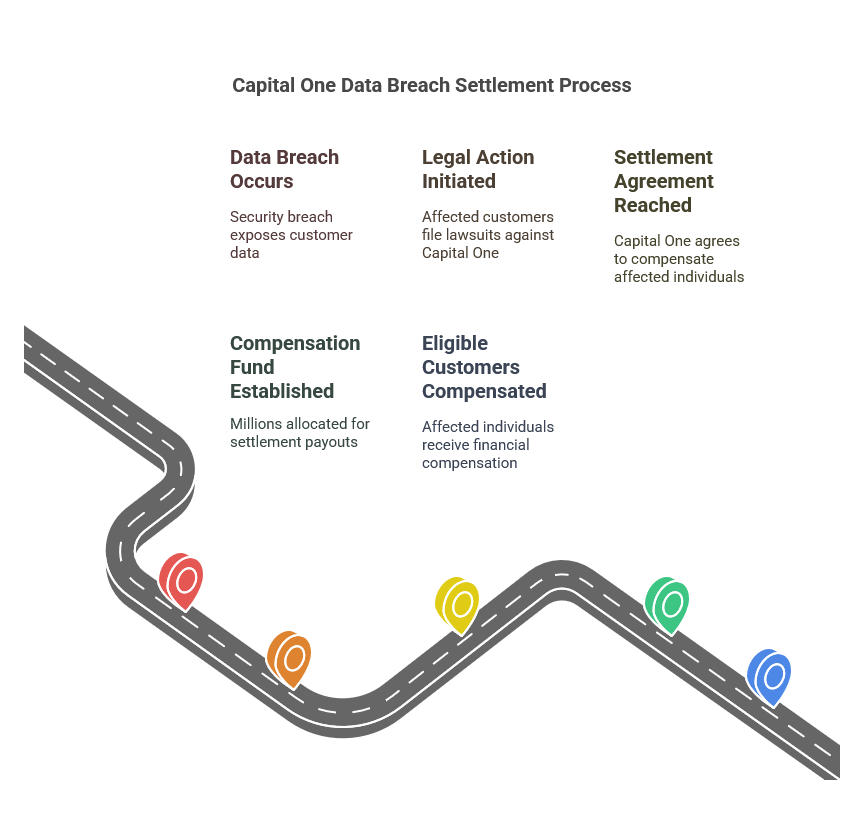

Following the breach, affected customers and others took legal action against Capital One, resulting in a settlement. The company agreed to compensate those impacted by the breach. The Capital One data breach settlement aims to compensate individuals for the emotional distress, financial losses, and other harms caused by the breach.

The company has set aside millions of dollars for this settlement, and customers who qualify can receive compensation. Let’s break down the key points of this settlement and how it may benefit you.

Who Is Eligible for the Settlement?

To qualify for compensation, you must have been affected by the Capital One data breach. You could claim compensation if you were a customer whose information was exposed. This includes people with credit card accounts who had applied for loans or interacted with the company during the breach.

To qualify, you don’t need to have experienced direct financial losses due to the breach. The settlement compensates for emotional distress caused by the breach. For example, if you spent time managing your personal information or felt stressed over the potential misuse of your data, you might qualify for compensation.

What Types of Compensation Are Available?

There are several ways in which the Capital One data breach settlement compensates affected individuals. Here are the primary forms of compensation available:

-

Cash Payments: Capital One is offering cash payments to eligible individuals. The payments aim to compensate for the distress, the time spent managing the breach, and the potential risk of fraud or identity theft.

-

Credit Monitoring Services: Affected individuals may receive free credit monitoring for a period. This service can help monitor your credit report for any unusual activity and protect you from future identity theft.

- Reimbursement for Expenses: You might receive reimbursement if you spent time or money protecting yourself from fraud due to the breach (such as purchasing identity theft protection or paying for credit freezes).

How to File a Claim for the Capital One Data Breach Settlement

Filing a claim for the Capital One data breach settlement is straightforward. You can submit your claim online by visiting the official settlement website. The process typically requires you to provide basic information, such as your name, address, and account details.

Once your claim is submitted, Capital One will review it to verify your eligibility. You’ll receive a payment, credit monitoring, or other reimbursement forms if you’re eligible for compensation.

It’s important to note that the deadline to file claims may be limited. Therefore, submit your claim immediately to avoid missing out on compensation.

How Much Money Will You Receive from the Settlement?

The amount of money you could receive from the Capital One data breach settlement depends on several factors. While there is no fixed payment, individuals may receive a portion of the settlement fund based on the harm they experienced due to the breach.

Some individuals may receive only a tiny amount, while others could get more. The actual payout depends on the number of claims filed and the total amount of the settlement fund.

It’s also worth noting that the settlement is designed to be equitable. This means that individuals who faced the most significant harm, such as those who spent more time or money protecting themselves, may receive a larger payout.

Why Should You File a Claim?

If you were affected by the Capital One data breach, filing a claim for compensation makes sense for several reasons:

-

Compensation for Time and Effort: Many individuals spent hours monitoring their credit, contacting financial institutions, and taking steps to protect their information. The settlement helps compensate you for this time and effort.

-

Financial Protection: Even if you didn’t directly experience economic losses due to the breach, the settlement protects against future fraud or identity theft. The free credit monitoring service can help prevent further damage. Official Website

-

Rightful Compensation: The Capital One data breach caused physical or emotional harm. Filing a claim ensures you receive compensation for the distress the breach caused.

How the Settlement Affects Capital One

For Capital One, the settlement is part of a broader effort to restore trust with its customers and the public. The data breach severely impacted the company’s reputation, and settling the lawsuits is a step toward resolving the issue.

The settlement also reminds other financial institutions and companies that protecting customer data is a top priority. If Capital One had better security measures, it might have avoided the breach altogether.

What’s Next After the Settlement?

After the settlement is finalized, the company will begin issuing payments and offering credit monitoring services. Customers who qualify for compensation can expect payments within a few months after filing their claims.

If you haven’t filed a claim, acting quickly before the deadline is essential. As the breach occurred several years ago, the deadline for filing claims may be approaching fast.

What Can You Do to Protect Your Information in the Future?

The Capital One data breach serves as a cautionary tale about the importance of protecting personal information. Here are some steps you can take to protect your data in the future:

-

Use Strong Passwords: Create complex passwords and change them regularly to protect your online accounts.

-

Enable Two-Factor Authentication: Many services offer two-factor authentication (2FA), which adds an extra layer of security to your accounts.

-

Monitor Your Credit: Regularly check your credit reports for signs of unauthorized activity.

-

Be Cautious with Personal Information: Avoid sharing sensitive information unless necessary, especially online.

-

Consider Identity Theft Protection: Identity theft protection can help you stay one step ahead of potential fraud.

Frequently Asked Questions (FAQs)

-

Who is eligible for the Capital One data breach settlement? Individuals whose personal data was exposed during the Capital One data breach may be eligible for compensation.

-

How do I file a claim for the settlement? You can file a claim online through the official Capital One data breach settlement website.

-

What types of compensation are available? Eligible individuals may receive cash payments, credit monitoring services, or reimbursement for expenses related to the breach.

-

How much money will I receive from the settlement? The amount of compensation varies, depending on the harm caused by the breach and the number of claims filed.

-

What should I do if I miss the filing deadline? You may no longer be eligible for compensation if the deadline has passed. However, you should still monitor your credit for any suspicious activity.

The Capital One data breach settlement provides compensation for millions of affected individuals. Whether you seek compensation for emotional distress, financial losses, or protection from future fraud, filing a claim is your opportunity to get the support you deserve. Remember that the deadline to file claims may be fast approaching, so act now to ensure you receive compensation.