Client bookkeeping solutions are designed to help businesses manage their finances in an efficient and organized manner. With proper bookkeeping, companies can ensure that their financial records are accurate and up-to-date, helping them make informed decisions. Bookkeeping solutions provide tools and resources that help businesses easily track their income, expenses, and other financial transactions.

In this article, we will explore the importance of client bookkeeping solutions and how they can improve the financial health of your business. If you are looking for effective ways to organize your business finances, client bookkeeping solutions are precisely what you need.

QuickBooks says 60% of small business owners find bookkeeping and accounting tasks stressful.

What Are Client Bookkeeping Solutions?

Client bookkeeping solutions refer to a variety of services and tools that businesses use to manage their financial records. These solutions help companies to track income, expenses, liabilities, and assets. They also ensure that financial statements are accurate, crucial for making business decisions, paying taxes, and maintaining financial transparency.

With client bookkeeping solutions, businesses can streamline their operations, reduce errors, and save time on financial management tasks. Whether a small business or a large enterprise, these solutions are scalable and can be tailored to your needs.

Why Every Business Needs Client Bookkeeping Solutions

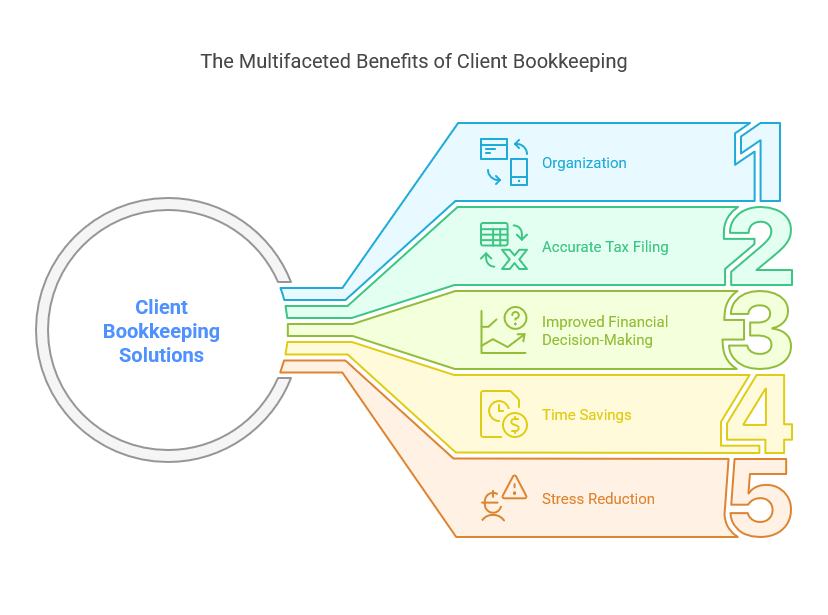

Bookkeeping might seem like a basic task, but without it, businesses risk losing track of their financial status. Here are a few reasons why client bookkeeping solutions are essential for every business:

-

Helps You Stay Organized

With client bookkeeping solutions, you can keep all your financial records in one place. This makes it easier to track transactions and generate accurate financial reports. -

Ensures Accurate Tax Filing

Accurate bookkeeping ensures that your business can file taxes correctly and on time. With the right bookkeeping solutions, you can avoid costly mistakes and penalties. -

Improves Financial Decision-Making

By having accurate financial data at your fingertips, you can make more informed decisions for your business. Proper bookkeeping helps you understand your cash flow, allowing you to make adjustments where necessary. -

Saves Time

Handling finances manually can be time-consuming and prone to errors. Using automated client bookkeeping solutions allows you to save time by automating tasks such as invoicing and expense tracking. -

Reduces Stress

Bookkeeping can be stressful, especially when it is not organized. With client bookkeeping solutions, you can streamline your processes, reduce the risk of errors, and lower your stress levels.

Types of Client Bookkeeping Solutions

Several client bookkeeping solutions are available, each catering to different business needs. These include:

-

Cloud-Based Solutions

Cloud-based bookkeeping solutions allow businesses to manage their finances remotely. This makes it easier for teams to access financial data from any device. -

Outsourced Bookkeeping Services

If you prefer to leave bookkeeping to the experts, outsourced bookkeeping services might be the right solution. These services handle everything from data entry to tax filing, allowing you to focus on growing your business. -

DIY Bookkeeping Software

Many businesses opt for DIY bookkeeping software. These software programs are often more affordable than outsourced services, allowing companies to manage their finances independently. Popular options include QuickBooks, Xero, and Wave. -

Integrated Solutions

Some client bookkeeping solutions integrate other business tools, such as invoicing and payroll software. These integrated solutions make it easy to manage all aspects of your business finances in one place.

Key Features of Client Bookkeeping Solutions

Client bookkeeping solutions have various features designed to make bookkeeping easier and more efficient. Here are some standard features to look out for:

-

Automated Data Entry

Some solutions can automatically import and categorize transactions, reducing the time spent on data entry. -

Real-Time Reporting

With real-time reporting, you can monitor your business’s financial health anytime. This feature helps companies to make quicker decisions based on the most up-to-date information. -

Tax Filing Assistance

Many client bookkeeping solutions offer tools that help businesses prepare their taxes, ensuring they comply with tax laws and avoid penalties. -

Expense Tracking

Tracking expenses is crucial for maintaining profitability. Client bookkeeping solutions often include tools that help businesses track their spending and reduce unnecessary costs. -

Mobile Access

Many cloud-based bookkeeping solutions allow you to access your financial records on the go via a mobile app.

The Benefits of Client Bookkeeping Solutions

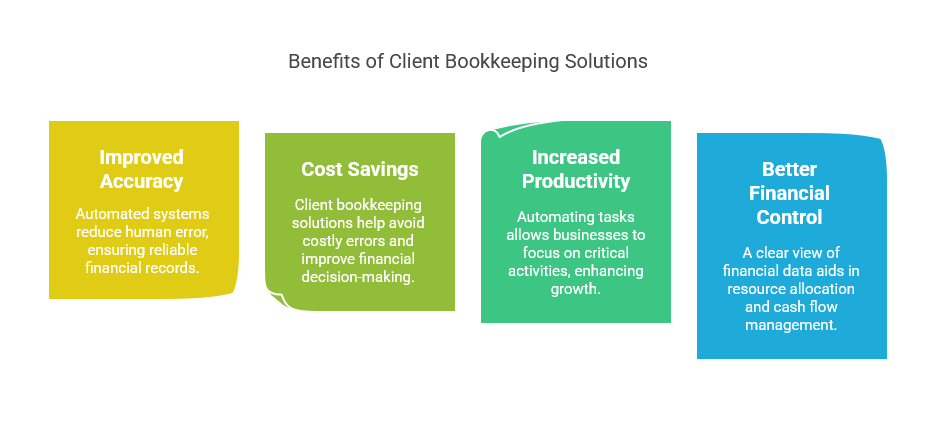

Using the proper client bookkeeping solutions can bring many benefits to your business. Some of the key advantages include:

-

Improved Accuracy

With automated systems, client bookkeeping solutions reduce the chances of human error. This ensures that your financial records are accurate and reliable. -

Cost Savings

Many businesses find that client bookkeeping solutions save them money in the long run. By avoiding costly errors and improving financial decision-making, these solutions can help reduce expenses. -

Increased Productivity

By automating tasks like invoicing, payroll, and expense tracking, businesses can free up time to focus on more critical tasks. This can lead to higher productivity and growth. -

Better Financial Control

With a clear view of your financial data, you can make better decisions about allocating resources, managing cash flow, and planning for the future.

How to Choose the Right Client Bookkeeping Solution

Choosing the right client bookkeeping solution can be overwhelming with many options. Here are some tips to help you select the best one for your business:

-

Understand Your Needs

Consider the size of your business, your budget, and the features you need. If you are a small business, you might prefer a simple DIY solution. Larger companies may need more robust, cloud-based systems. -

Check for Integration

Ensure the bookkeeping solution integrates with your existing business tools, such as payroll or invoicing software. -

Consider Customer Support

Choose a solution with reliable customer support. You might need help with setup or troubleshooting, so having access to a support team is essential. -

Read Reviews

Before committing to a solution, read reviews from other businesses. This can help you understand how well the solution works in real-world scenarios. -

Look for Security Features

Financial data is sensitive, so ensure your chosen solution has strong security features to protect your information.

FAQ About Client Bookkeeping Solutions

-

What is a client bookkeeping solution?

A client bookkeeping solution is a service or tool that helps businesses manage their financial records, including income, expenses, and taxes. -

Do I need a bookkeeping solution if I have a small business?

Yes, even small businesses can benefit from bookkeeping solutions to stay organized and manage their finances effectively. -

Can I automate my bookkeeping with client bookkeeping solutions?

Many client bookkeeping solutions offer automation for tasks like data entry, invoicing, and expense tracking. -

What are the main advantages of using client bookkeeping solutions?

The main advantages include improved accuracy, cost savings, increased productivity, and better financial control. -

How do I choose the right bookkeeping solution for my business?

Consider your business size, needs, budget, and integration with other tools when choosing a solution.

Client bookkeeping solutions are an essential part of running a successful business. They provide numerous benefits, from improving accuracy to saving time and money. Whether you are looking for a cloud-based solution or an outsourced service, these tools can help you manage your finances more effectively and ensure the growth of your business.

By using the correct client bookkeeping solutions, you can take control of your financial future and make informed decisions that benefit your bottom line.