Financial advisor athletes need expert guidance to secure their wealth. Many athletes earn millions but struggle to keep it. Lavish spending, bad investments, and poor advice lead to financial trouble. A financial advisor helps athletes manage wealth, invest wisely, and plan for the future. Without one, money disappears quickly.

78% of former NFL players face financial stress within two years of retirement

Why Athletes Need a Financial Advisor

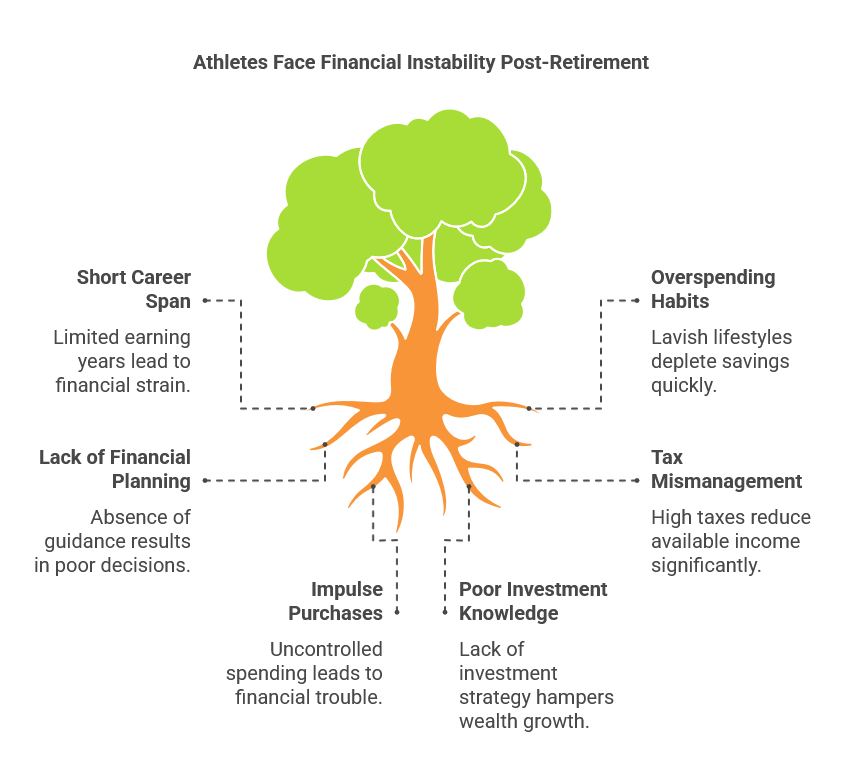

Short Career, Long Life

Most athletes retire before 40. After that, they need a steady income. A financial advisor helps plan for the future. Without guidance, athletes risk running out of money too soon. The reality is that an athlete’s peak earning years are brief, while their post-career life can last decades. Without a structured financial plan, many struggle to maintain their lifestyle.

Risk of Overspending

Luxury cars, big houses, and lavish lifestyles drain money fast. Without a plan, savings won’t last. Some athletes make the mistake of thinking the money will always flow. Unfortunately, without proper planning, they often face financial trouble after retirement. Overspending can be a significant issue, especially with impulse purchases, bad financial habits, and keeping up with a high-profile social circle.

Taxes and Investments

Significant earnings mean high taxes. Smart investments reduce the tax burden. Advisors help athletes invest wisely. Managing tax payments efficiently allows athletes to keep more of their hard-earned money. Advisors guide them on legal ways to maximize their wealth. Many athletes don’t realize how much they owe in taxes and have financial issues. Proper planning prevents tax problems and ensures financial security.

What a Financial Advisor Does for Athletes

Budgeting and Saving

A financial advisor creates a structured plan. They help athletes manage money wisely by setting spending limits, controlling unnecessary expenses, and setting aside savings. Budgeting is crucial for avoiding financial stress. Advisors help create a spending plan that balances short-term enjoyment with long-term security.

Investing for Growth

Smart investments grow wealth. Stocks, bonds, and real estate create long-term security. Diversification helps athletes reduce risks and build a stable financial foundation. Investing in safe, income-generating assets is key. Advisors help athletes understand the difference between good and bad investments, ensuring economic growth.

Tax Strategies

Athletes pay high taxes. Advisors use legal ways to reduce tax payments through deductions, tax-deferred investments, and strategic financial planning. Tax management ensures athletes pay what is required but do not overpay. Structured tax plans can save athletes millions over their careers.

Retirement Planning

Many athletes lose income after sports. Advisors create retirement plans that provide lifelong income. Planning ensures a comfortable life post-retirement without financial struggles. Athletes planning early retirement are likelier to maintain their lifestyle after leaving the sport.

Avoiding Scams

Many athletes lose money to fraud. Advisors protect them from bad investments by evaluating risks and ensuring transparency before making financial decisions. Scams targeting athletes are common, and having a trustworthy financial advisor reduces the risk of falling victim to bad deals.

Famous Athletes Who Went Broke

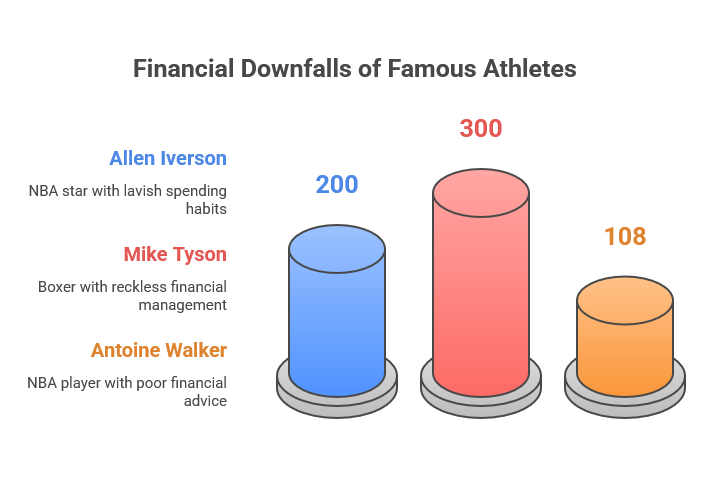

Allen Iverson

The NBA star earned over $200 million. However, lousy spending and a lack of financial planning led to bankruptcy. His downfall was expensive jewelry, cars, and a lack of budgeting.

Mike Tyson

The boxer made over $300 million. Bad investments and reckless spending broke him, and lavish purchases, lawsuits, and mismanagement drained his wealth.

Antoine Walker

The NBA player lost $108 million. Poor financial advice was a big reason. A high-spending lifestyle, risky investments, and trusting the wrong people also contributed.

Other Athletes Who Faced Financial Struggles

Many more athletes have faced financial issues. Terrell Owens, Latrell Sprewell, and Dennis Rodman struggled financially after their sports careers ended. Their stories highlight the importance of financial planning.

Best Financial Advice for Athletes

Save First, Spend Later

A financial advisor helps create a savings-first habit. This ensures financial security for the future. Prioritizing saving over unnecessary spending is a key principle for long-term wealth.

Invest in Assets, Not Liabilities

Expensive cars and jewelry lose value, while real estate and stocks grow wealth. Advisors help athletes distinguish between suitable investments and unnecessary spending. A vehicle may look great, but its value declines over time, whereas a property or a stock portfolio can provide passive income.

Build Passive Income

Business investments and rental properties create income even after retirement. Athletes need income streams that continue long after they stop playing. Smart investments in businesses or properties can sustain an athlete’s lifestyle even after their playing days.

Plan for Life After Sports

A solid financial plan means no stress after leaving the game. Advisors help athletes transition into new careers or business ventures. Some athletes enter coaching, broadcasting, or business, and having a financial plan allows them to explore new opportunities without monetary pressure.

Avoid Bad Advice

Many athletes lose money by trusting the wrong people. Working with a qualified advisor reduces this risk. Not every financial opportunity is good; advisors help athletes avoid bad deals and fraudulent schemes.

Finding the Right Financial Advisor

Choose a Certified Professional

Look for a Certified Financial Planner (CFP). They have training and experience. Avoid unqualified or self-proclaimed “experts.” A CFP is more reliable and trustworthy.

Check Their Experience with Athletes

Not all advisors understand sports finances. Find one who has worked with athletes before. They must realize short career spans, endorsement deals, and tax implications.

Ask About Their Fees

Some advisors charge high fees. Look for a fair and transparent pricing system. Athletes should understand how their advisor gets paid to avoid conflicts of interest.

Research Their Reputation

Check online reviews, testimonials, and background information. A good advisor has a strong track record of helping athletes grow wealth.

FAQs

1. Why do athletes need a financial advisor?

Athletes earn big money in a short time. Advisors help them manage it wisely to secure long-term wealth.

2. What is the most prominent mistake athletes make with money?

Overspending, poor investments, and trusting the wrong people are common mistakes.

3. How can an athlete grow their wealth after retirement?

Smart investments in real estate, stocks, businesses, and passive income sources help grow wealth.

4. What type of financial advisor should an athlete hire?

The best choice is a certified financial planner (CFP) with experience in sports finance. They understand the unique needs of professional athletes.

5. How can an athlete avoid financial scams?

By working with a trusted financial advisor, researching before making investments, and avoiding “get rich quick” schemes.

A financial advisor is not a luxury. It’s a necessity. Athletes who fail to plan often face financial ruin. Proper money management, wise investments, and savings habits secure a stable future. Millions can vanish fast without a structured plan. The right financial advisor ensures that athletes make the most of their earnings, securing wealth for years.