If you’re struggling to keep your business finances organized, the Financial Fusion Accounting Tool might be the solution you’re looking for. Many small business owners, freelancers, and even large companies use automated solutions like Financial Fusion to simplify accounting tasks. But does it live up to the expectations? Let’s dive into an honest and detailed review of the Financial Fusion Accounting Tool to help you decide if it’s the right choice for your needs.

What is a Financial Fusion Accounting Tool?

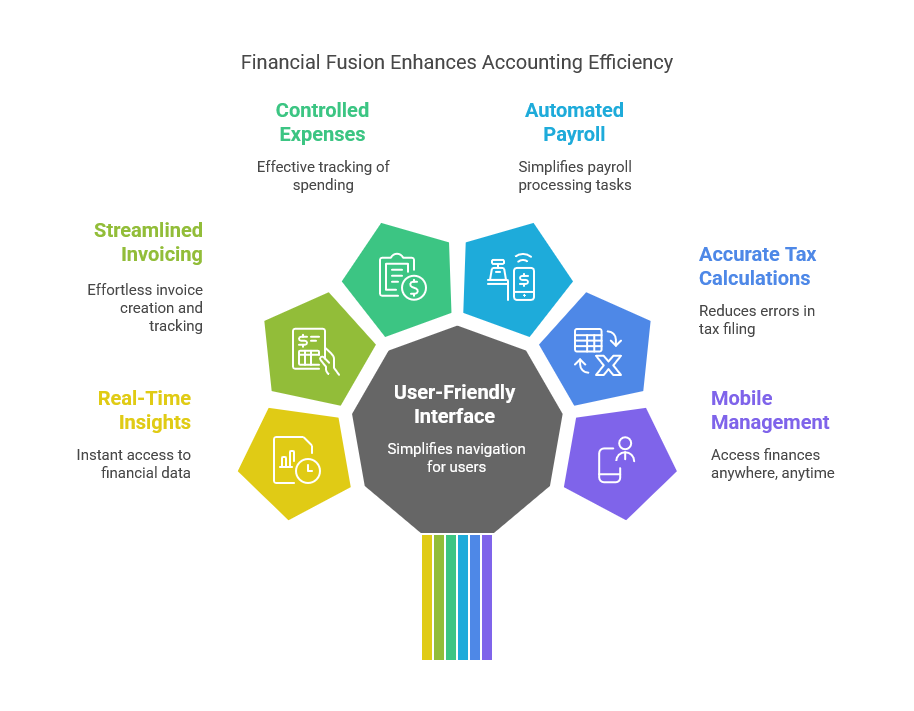

Financial Fusion is comprehensive accounting software designed to streamline financial management for businesses. The tool provides an all-in-one platform to manage everything from invoicing to expense tracking, payroll, and even tax calculations. Its goal is to help companies to save time and reduce errors while handling their finances.

Whether you are managing a small startup or a larger enterprise, Financial Fusion can adapt to your needs. With a user-friendly interface, customizable features, and powerful integrations, it’s a versatile solution for business owners who want to focus more on growing their business than managing accounts.

Key Features of the Financial Fusion Accounting Tool

1. Easy-to-Use Interface

Financial Fusion is known for its clean and straightforward interface. The intuitive dashboard makes navigating easy for users with limited accounting knowledge. Everything from expense tracking to invoicing and payroll is a few clicks away. Users don’t have to spend hours learning complicated processes or searching complex menus.

2. Real-Time Reporting

One of the most valuable features of the Financial Fusion Accounting Tool is its real-time reporting. It allows business owners to access income, expenses, profits, and tax reports instantly. This gives a clear view of the company’s financial health at any given moment. You can also customize reports according to your needs, which is a big plus for companies with unique accounting requirements.

3. Invoicing and Payment Tracking

Financial Fusion simplifies invoicing by allowing users to create professional invoices and track payments effortlessly. It supports integration with various payment platforms, including PayPal, Stripe, and credit card payments. This means you can quickly send out invoices and receive payments in real-time, keeping your cash flow healthy.

4. Expense Management

Managing business expenses is crucial, and Financial Fusion makes this easy. The tool allows you to categorize and track your expenses, ensuring you always know where your money goes. This feature helps to keep your spending under control, which is especially useful for small businesses trying to stick to a budget.

5. Payroll Automation

For businesses with employees, the payroll feature is a lifesaver. Financial Fusion allows you to automate payroll calculations, including tax deductions, benefits, and other components. You can generate payslips and even directly deposit salaries into employees’ bank accounts, reducing the manual work involved in payroll processing.

6. Tax Calculations

Another key benefit of Financial Fusion is its tax calculation feature. The software automatically calculates taxes based on your input financial data, making tax season much less stressful. You can also generate tax reports to file with local authorities, ensuring compliance with tax laws and reducing the risk of errors.

7. Mobile Access

For business owners on the go, the Financial Fusion mobile app is a handy tool. It allows you to manage your finances from anywhere, whether traveling or working remotely. The mobile version is streamlined, yet it still offers all the core features available on the desktop.

Pros of Financial Fusion Accounting Tool

1. User-Friendly Design

As mentioned earlier, Financial Fusion’s interface is simple to navigate. You don’t need a financial expert to use the tool effectively. Whether creating invoices or managing expenses, it’s designed for anyone.

2. Automation Saves Time

The automation features of Financial Fusion are a big plus. Automating invoices to payroll and tax calculations saves business owners much time. By reducing manual work, you can focus on growing your business rather than getting bogged down by administrative tasks.

3. Customizable Features

Financial Fusion allows you to tailor the tool to your business needs. The tool can be adjusted to suit your workflow, whether you need to create custom reports or set up specific categories for your expenses. This flexibility is ideal for businesses of various sizes.

4. Comprehensive Financial Insights

With real-time reports and analytics, Financial Fusion provides businesses with a clear overview of their financial status. This makes it easy to make informed decisions about your business’s future. You’ll never be dark about your cash flow, profits, or losses.

5. Affordable Pricing

Financial Fusion offers competitive pricing compared to other accounting tools on the market. It’s affordable for small businesses and startups, making it accessible even to those on a tight budget. Different pricing plans allow you to choose one that fits your needs.

Cons of Financial Fusion Accounting Tool

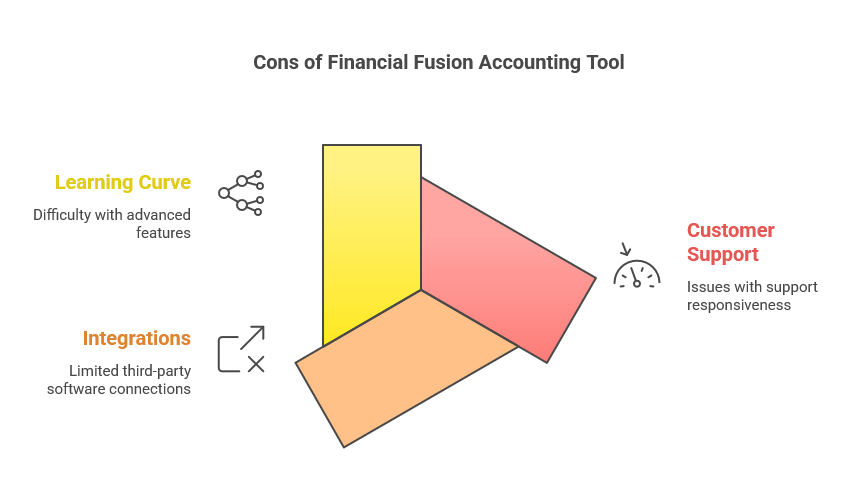

1. Limited Customer Support

Some users have reported issues with customer support, stating that responses can be slow. While resources are available, such as an FAQ section and tutorial videos, live support can sometimes be lacking, which could be frustrating if you encounter issues.

2. Limited Integrations

While Financial Fusion integrates with several popular payment platforms, it has fewer third-party integrations than other accounting tools. This might be a dealbreaker for businesses that rely on various software solutions to manage their operations.

3. Learning Curve for Advanced Features

While the essential functions are easy to grasp, some more advanced features, such as custom reports or payroll automation, may take time to learn. New users might spend some time experimenting to get everything set up correctly.

Is Financial Fusion Accounting Tool Worth It?

Financial Fusion is a solid choice for small and medium-sized businesses. It offers a range of features that simplify accounting tasks and help business owners manage their finances. The tool provides a comprehensive financial management solution, from invoicing to payroll, tax calculations, and real-time reporting.

However, businesses with more complex needs or those relying on multiple third-party integrations might find the tool limiting. The customer support and advanced features could also be better, but overall, it’s a reliable, affordable accounting tool for most small business owners.

Financial Fusion vs. Competitors: How Does It Stack Up?

Financial Fusion holds its own compared to other accounting software like QuickBooks, FreshBooks, or Xero. QuickBooks is more widely recognized but can be pricier, especially for larger businesses. Xero offers many integrations but may not be as user-friendly. On the other hand, Financial Fusion provides a balance of affordability, simplicity, and a good feature set.

Frequently Asked Questions

1. What types of businesses can benefit from Financial Fusion?

Financial Fusion is suitable for small to medium-sized businesses, startups, and freelancers who need an easy-to-use tool for managing their finances.

2. Is Financial Fusion suitable for large businesses?

While Financial Fusion is great for small and medium businesses, larger companies with more complex accounting needs may find it lacking in some advanced features.

3. Can I track expenses with Financial Fusion?

Financial Fusion has a robust expense tracking system that categorizes and tracks your spending to help keep your business budget on track.

4. Does Financial Fusion provide tax reports?

Yes, the tool helps you calculate taxes automatically and generate tax reports for filing with local authorities.

5. Is Financial Fusion easy to use for beginners?

Yes, Financial Fusion is designed with simplicity in mind. It’s easy for beginners and non-accountants to use, even without financial experience.

The Financial Fusion Accounting Tool is a solid choice for small and medium-sized businesses seeking an affordable, easy-to-use accounting solution. With features like invoicing, real-time reports, payroll automation, and expense management, it can save business owners time and reduce the complexity of managing finances. While it may not be the best choice for larger businesses or those needing advanced integrations, it’s an excellent tool for those starting or looking to streamline their financial operations.